Thai central bank eases mortgage rules to support property sector

-

Recently Browsing 0 members

- No registered users viewing this page.

Announcements

-

Topics

-

-

Popular Contributors

-

-

Latest posts...

-

14

Trump: The Big Beautiful Failure

The trouble with any posts like this takes me back to a college course Technical Writing 101. The primary tenet was "consider your audience." We essentially have two camps - those with working brains (aka "the choir") and those with nonfuntional brains (aka "MAGAnistas"). You won't receive anything other than thumbs down from the nonfunctional brains camp because they have no reasonable arguments. Your points are backed by facts, Kryptonite to the MAGAnistas. For the rest of us, you're preaching to the choir. I'll get the perfunctory thumbs down for this post from the MAGAnistas without so much as a reply calling me anything from their boring bag of standard name-calling (leftie, woke, blah blah blah). Because, again, they have no arguments they can back up with facts though I wish they'd try.- 1

-

-

14

Trump: The Big Beautiful Failure

No such noun in the English language. OTOH, there is the slang term <deleted>. The cap fits quite well....... -

2

-

32

-

2

Putin poo collected in a briefcase to take home

Do you think he dumps straight into the suitcase? Imagine customs and excise pulling you over......did you pack everything yourself? Would you mind opening your case please sir? -

14

Trump: The Big Beautiful Failure

I think he's referring to the deranged copying of a Law and Order SVU plot about an encounter in the changing room. The "victim" went on to describe rape as "sexy". 100% horse pucky.

-

-

Popular in The Pub

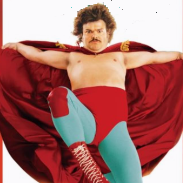

.thumb.jpg.3ee24d9400fb02605ea21bc13b1bf901.jpg)

Recommended Posts

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now