Expert from Thai Revenue Department to speak about rules on foreign income at Hua Hin event

-

Recently Browsing 0 members

- No registered users viewing this page.

-

Topics

-

Popular Contributors

-

Latest posts...

-

48

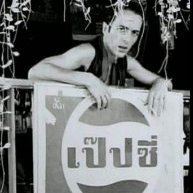

Crime Thai Singer Sek Loso Sentenced to 3 Years Without Parole

Guess you believe urban myths...there are no "penthouse suites" in Thai prisons. -

86

Report Thailand to Require Medical Certificates for Cannabis Use Within 40 Days

I fully expect that those "medical certificates" will be sold by clinics just like they're already selling certificates for driving licenses, work permits, university admissions and whatnot - a useless paper shuffling exercise without any tangible benefit (other than to the clinics $$). -

135

Trump ambushes South African president at White House meeting

Oh dear, the Trump fanboys club has been fooled again. When will they learn? I suggest posters read https://www.bbc.co.uk/news/articles/ce81334je72o Fact Checking Trump's Oval Office confontration with Ramaphos The rows of white crosses along a rural road which Trump claimed were burial sites of over a thousand white farmers were in fact a temporary memorial in protest against the murder of one white farming couple Glen and Vida Rafferty, who were ambushed and shot dead on their premises in 2020. The crosses are no longer there. Out of a total of 26,232 murders in South Africa last year, 44 were killings of people within the farming community and of those, only eight were of farmers. Hardly figures of genocide! The image Trump showed which he claimed was evidence of white farmer killings in South Africa isn't from South Africa - it's actually from a report about women being killed in the Democratic Republic of Congo!- 1

-

-

15

Dating 22-Year-Old Thai Bubble Tea Girl - She Just Asked for 30K/Month – Am I Being Played?

Don't buy the cow.... Rent -

33

Trump U.S. FDA’s new approach to covid vaccines could have been way worse

The average Thai still cares - hence why they cling onto their muzzles like newborn holds onto its milk bottle. -

15

Dating 22-Year-Old Thai Bubble Tea Girl - She Just Asked for 30K/Month – Am I Being Played?

I'll be your friend for 20k a month only, ok?- 1

-

-

-

Popular in The Pub

-

.thumb.jpg.3ee24d9400fb02605ea21bc13b1bf901.jpg)

.thumb.jpeg.d2d19a66404642fd9ff62d6262fd153e.jpeg)

Recommended Posts

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now