Thailand to tax residents’ foreign income irrespective of remittance

-

Recently Browsing 0 members

- No registered users viewing this page.

-

Topics

-

-

Popular Contributors

-

-

Latest posts...

-

39

-

13

Jomtien immigration: retirement extension without 800k (went today) with agent.

I like to Know if this procedure is Legal By Law or Legal By IMM or Not Or only Legal for Certain People /Imm Officers . If one wants to use an Agent for one reason or an other and IMM decides to Refuse the Application because they had a Bad day one could be in some trouble if one hasn't got the 800K Right. So you being one of the MODS you should look into this and make this Clear for Everyone to know . Thank you . -

4

What is this expanding patch of rough skin?

I have something similar on my ankle and have been to several doctors and skin specialists. Nearly all the medications I have received seemed to clear it up, but when I stopped using them it came back again. I have learnt to live with it and as soon as I feel the skin drying out I apply some cream. -

11

Financial requirement 500K THB for one-year extension of non-O visa

That will depend on the local bank branches and your wife's nationality, I wouldn't take this lightly right now. She will probably need some additional supporting documents, such as secondary ID from her passport country (ID card or DL) and Thai proof of residence (residence certificate from immigration, lease, etc.). Even then, some banks will likely just say "no" in the current climate. -

25

Report Drive Drunk, Lose Your Car: Thailand’s OAG Pushes Tough New Proposal

Me too, but it wont. -

0

Gunman Opens Fire on ‘No Kings’ Protest in Salt Lake City

The right wing terror continues. Another violent episode making the "socialist terrorist" screechers look like even bigger fools. Gunman Opens Fire on ‘No Kings’ Protest in Salt Lake City "A gunman opened fire on thousands of protesters in Salt Lake City, Utah, on Saturday evening. One person has been critically injured while a suspect has been taken into custody by police, authorities have said. “We can confirm the shooting resulted in one person being critically injured,” the agency said in a social media post. “The patient has been taken to a hospital with life-threatening injuries”."

-

-

Popular in The Pub

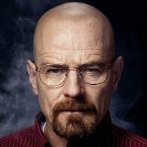

.thumb.jpeg.d2d19a66404642fd9ff62d6262fd153e.jpeg)

Recommended Posts

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now