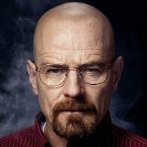

Steve Bannon Clashes with Elon Musk: "We’re Going to Rip Your Face Off"

-

Recently Browsing 0 members

- No registered users viewing this page.

-

Topics

-

-

Popular Contributors

-

-

Latest posts...

-

7

Crime Neighbour Shoots Motorcycle Repairman Over Late-Night Noise in Khon Kaen

Charges should be brought against the local municipality, as well! For not handling the dispute thats been allowed to fester. This is becoming increasingly common! Thai’s settling disputes with violence because of noise nuisance . Excessive noise by Dog’s , music, cars, motorcycles , drunks or arguing people suck. -

117

Report Pattaya Plans AI Drone Patrols to Hunt Overstayers and Crooks in Real Time

I still see the Police Beemers with the facial recognition kit on the roof cutting about Chonburi and Songkhla when I am down there. -

0

Retirement Visa/Overstay

I'm on a marriage extension and have no idea how retirement visas work. A friend rang me tonight. He was on his first retirement visa which he thought expired next month. Unfortunately, he either misread or likely forgot that it expired 2 weeks ago. He is now on a 14 day overstay. He will go to Immigration to clear up the 500 Baht per day overstay fine tomorrow. What is the procedure then, does he need to apply for a new retirement visa straight away? To make matters worse, his passport (US) only has 1 blank page. Would appreciate any advice as he's quite worried. TIA -

117

Report Pattaya Plans AI Drone Patrols to Hunt Overstayers and Crooks in Real Time

Are you referring to the billion Baht traffic light control system that the Police sabotaged? Fun times. -

85

Almost can't stand all that Trump winning on his B Day.

No mention of the enormous amounts of money that the Royal Family generate? The benefits to charities of their support? The amount funded by the British tax payer is dwarfed by the other side of the ledger. Pretty useful in my eyes. -

30

UK Aid Budget Strained as Asylum Hotel Costs Surge Amidst Overseas Cuts

Seems to be the Cloward–Piven strategy they're following: This is a political strategy outlined in 1966 by American sociologists and political activists Richard Cloward and Frances Fox Piven. The strategy aims to utilize "militant anti poverty groups" to facilitate a "political crisis" by overloading the welfare system via an increase in welfare claims, forcing the creation of a system of guaranteed minimum income and "redistributing income through the federal government. https://en.wikipedia.org/wiki/Cloward–Piven_strategy Theoretical Framework The Cloward-Piven strategy is grounded in the following key principles: Mass Mobilization: Encouraging a large number of eligible individuals to apply for welfare benefits simultaneously to create a systemic overload. Crisis Creation: By overwhelming the welfare system, the strategy seeks to precipitate a fiscal and operational crisis, demonstrating the insufficiency of current social policies. Policy Change: The ultimate goal is to force the government to address the crisis through significant policy reforms, ideally leading to more comprehensive welfare provisions and a stronger social safety net. https://medium.com/@kootie73/cloward-piven-strategy-the-cloward-piven-strategy-named-after-sociologists-richard-cloward-and-664cdc29a254 Unfortunately it all collapses in the end when you run out of other people's money.

-

-

Popular in The Pub

.thumb.jpeg.d2d19a66404642fd9ff62d6262fd153e.jpeg)

.thumb.gif.4320be21824a949fd08700f6ee740303.gif)

Recommended Posts

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now