Don’t kill the golden goose! Tax reforms may drive away expats

-

Recently Browsing 0 members

- No registered users viewing this page.

-

Topics

-

-

Popular Contributors

-

-

Latest posts...

-

115

Too late, baby - Muslim Mayor of NYC

I do as I've seen it before. And raise the quality of your insults, you're showing up your inner geriatric. -

115

-

17

US CDC report shows no link between thimerosal-containing vaccines and autism

No one has found the evidence. And not going to either. A virus is simply cell debris. Dead and inert. -

69

UK Caribbean Delegation to Push for Slavery Reparations in Historic Westminster Visit

And the Muslims and Africans still do, as well as the Chinese. -

130

Report New Cannabis Regulation: Prescription Required for Sales

Where do you live? I don't see anybody smoking weed in Pattaya where I live in Pratumnak; though I do smell it sometimes on Soi 5; but nowhere else. I don't see why people are getting so grouchy -

31

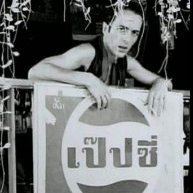

Chatting up the farang totty.

Second from the left removed her fist from Bob just before the snap.

-

-

Popular in The Pub

Recommended Posts

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now