How long can Thailand’s central bank swim against the tide?

-

Recently Browsing 0 members

- No registered users viewing this page.

-

Topics

-

-

Popular Contributors

-

-

Latest posts...

-

38

Does anyone do short-term trading and can give advice for my wife please?

Since I came back to Caaannnaaaadaaa I opened the account with Questrade because of their zero comission fees. It is not that difficult to turn in a small profit trading blue chip companies even on their way down. The zero comission really helps, something which I doubt is available in canada. Even if you f up, the blue chip companies like Enbridge will pay you 6% dividend, so you can just wait it out. A nice little earner. -

44

Tourism Thailand Rethinks Tourism Strategy After 34% Plunge in Chinese Arrivals

Fill up whole Thailand with criminals from Russia.. India and don't forget Israeli people. Arabs too..make them take over Phuket and u get what u asked for. Make sure to manipulate the bath and charge double for everything..let the few tourists pay for everyone. Make sure to raise prices minimum 36-46%. Thailand is the hub for criminals on the run and weed smugglers. Double the ATM-fees too.Ur greediness will never change. -

40

Health Rabies Deaths Triple in Thailand: Urgent Alerts Issued

No... It just makes you someone who commented without reading any other part of this thread !!! Because it was answered here >>> I'm referring to a handful of folk on this forum who are 100% against ALL vaccines... any... and that goes for Measles (MMR), Polio etc... (so not just a covid vax discussion - which again is separate conversation, but also somewhat based around the hysteria of the anti-vax movement).... And yes, as far as tested and proven vaccines are concerned... if someone is anti-vaccination, be it Rabies, Polio, MMR etc... then I am most definitely not with you, and by very definition, against you (and whoever the 'us' is you refer to). -

13

-

4

Immigration appointment 18th July 2025 for first retirement 1 year extension visa

Type on the form and print is fine. Just leave the signature and sign in front of them on the day (not sure if that is strictly necessary but no harm in it - I always sign in front of them) -

182

UK Mohammed Fahir Amaaz & Muhammad Amaad on Trial over Manchester Airport Clash

Takes a fool to recognise a fool. Assault was on the 26 Oct 2024, charged on the 7 Nov 2024, so offense to being charged less than a month. On the flimsiest video evidense but not to dissimilar to the Manchester case. Court hearing 24 Feb 2025 being charged to court hearing 3 months. Pleading guilty of not the plea would not have been until he attended court.- 1

-

-

-

Popular in The Pub

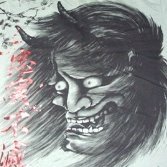

.thumb.jpeg.42eea318e3350459f0aaaa5460326bca.jpeg)

Recommended Posts

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now