Thailand Unveils 10-Year Visa to Attract Top Global Talent

-

Recently Browsing 0 members

- No registered users viewing this page.

-

Topics

-

Popular Contributors

-

Latest posts...

-

145

Why do so many posters continually diss other posters?

OP is right. After a moment of reflection, I'd like to apologize to @bob smith. By the way, Bob, @transam is back, so it is safe for your return. -

14

-

59

-

82

Denied Entry

Rules??? All I can say is that i've been going to thailand since 2016 and i have had many type of visas, lots of tourist visas. Never had a problem 😴 -

145

Why do so many posters continually diss other posters?

No need to look down. Posting your opinion that it´s not the right way to go, is not looking down. 🙂 -

82

Denied Entry

Please state the rules you keep referring to. It's a simple question. Actually don't bother as there are none. It was a rhetorical question.

-

-

Popular in The Pub

-

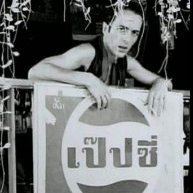

.thumb.jpg.3ee24d9400fb02605ea21bc13b1bf901.jpg)

Recommended Posts

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now